BACK TO POSTS

BACK TO POSTS

The Rise of Alternative Investments - BTX Breeding

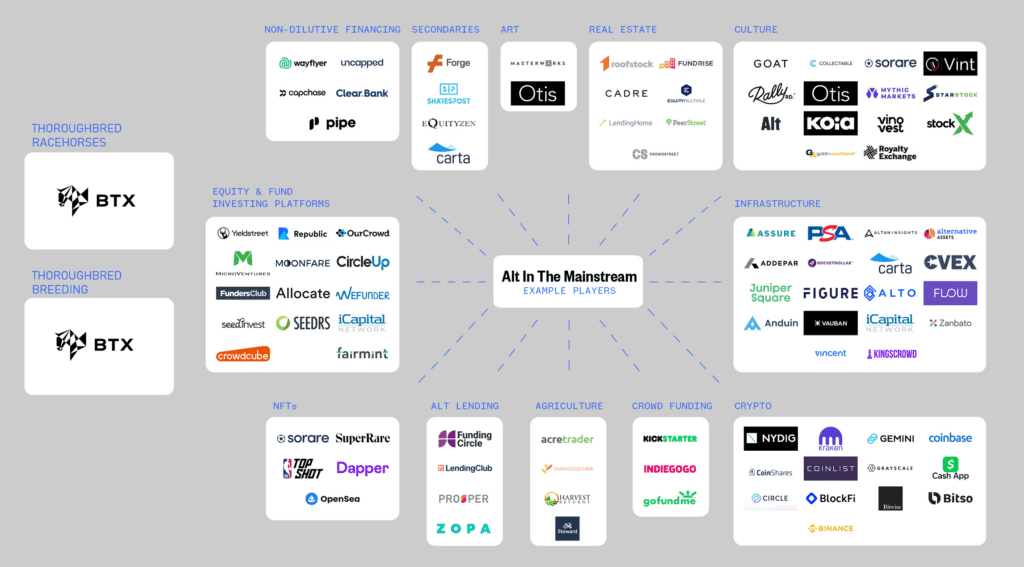

From fine wine, artworks, collectibles and more, investors are increasingly seeking to diversify their investment portfolio beyond the traditional stock market. According to a recent poll by Cerulli Associates, Asset Managers have increased their allocation to alternative investments by a staggering 10% in the first half of 2022, reaching around 15% of their total investments. A compelling 2022 Prequin report projects that the Global Alternatives Industry will nearly double in size within the next five years, surging from an estimated $13.32 trillion in 2021 to a mind-boggling $23.21 trillion by 2026.

It’s clear alternative investments have taken the financial world by storm, captivating the attention of investors worldwide. Historically, access to most alternative assets has been difficult for individual investors due to the lack of transparency, high investment thresholds and minimal education regarding alternative investment opportunities. Now, technology, innovation and regulatory changes are providing more everyday individuals with the opportunity to invest in alternative solutions.

Source: Alt Goes Mainstream, PitchBook

What is an Alternative Investment?

An Alternative Investment is an investment in non-traditional assets to potentially generate returns. Historical examples of such investments include real estate, gold, art, whisky, wine and now, racing and breeding investments.

People choose to invest in alternative assets for several reasons. Firstly, alternative investments offer diversification benefits allowing individuals to spread their investments across different types of assets. This method can help reduce overall risk and volatility in their portfolios. Secondly, alternative assets have the potential to generate higher returns compared to traditional investments. Thirdly, alternative assets provide access to unique investment opportunities that are not typically available through traditional avenues. This allows investors to customise their portfolios to align with their personal preferences and interests such as investments that come with an associated experience.

Examples of outperforming alternate asset classes:

The performance represented in this chart ranges from January 1, 2015 to December 31, 2022. Fine wine – Liv-ex Fine Wine 1000 Index. Fine whiskey – Rare Whisky Icon 100 Index. S&P 500 – S&P 500 Index. Gold – LBMA Gold Price. US Corporate Bonds – S&P 500 Investment Grade Corporate Bond Index. Real Estate – S&P/Case-Shiller U.S. National Home Price Index.

Source: Vinovest

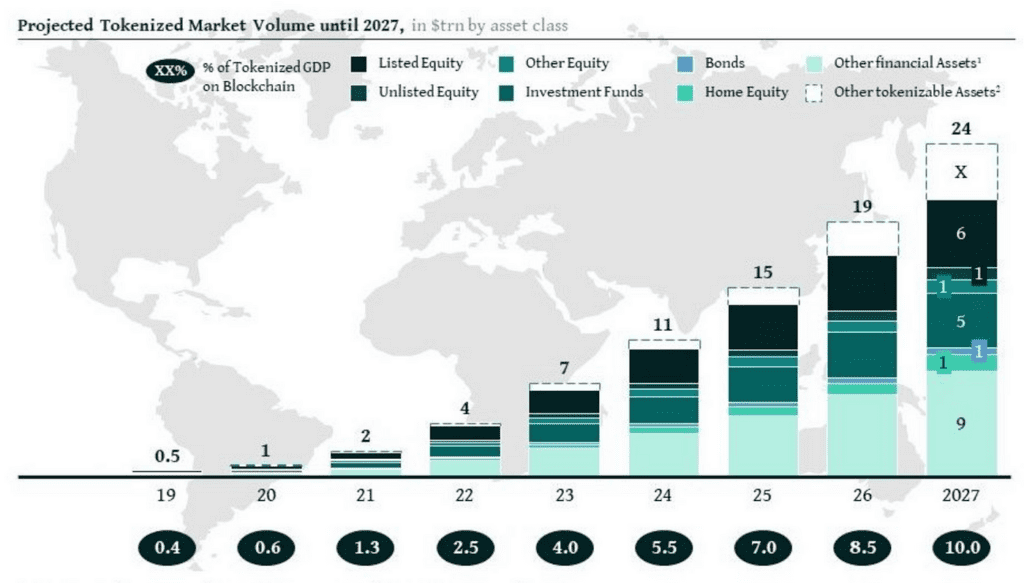

The Role of Blockchain in Alternative Investing

Blockchain technology is changing the way people invest in alternative assets by making them more transparent, secure and easier to trade. With blockchain, information about investments is recorded in a digital ledger that everyone can see, which helps build trust.

Blockchain also keeps investments safe by using advanced technology to protect against fraud or tampering. It does this by storing investment records in unique ways making it very difficult for anyone to change or cheat the system. It also uses smart contracts, which are digital agreements, to make sure everything happens correctly and fairly.

Another great thing about blockchain is that it makes it possible to own just a small part of an investment, like a fraction of a valuable painting or a piece of real estate. This means more people can invest in unique assets making alternative investments more accessible and flexible.

Source: The Rise of Blockchain-Based Funds: NEU Blockchain Organization

The BTX Breeding Alternative Investment Product

At BTX, we are excited to introduce our own alternative asset investment which offers a unique opportunity for investors to enter the exhilarating world of thoroughbred breeding.

Until now, breeding has been an alternative asset class most commonly reserved for those with deep pockets. Data shows that more than $590 million was spent across the five major select yearling sales in Australasia in 2022. That total spend is an increase of nearly 17.9 % or $90 million across the same sales the previous year. So, why is racehorse breeding gaining attention and popularity as an alternative investment product? One significant factor is the allure of the racing industry itself. Horse racing has long captivated people with its excitement, prestige and potential for triumph. Investing in breeding allows individuals to become a part of this thrilling world where champions are born and dreams are realised. With achievements on the track comes the ability to monetise this success through the breeding and sale of foals and future progeny with the aim of achieving significant returns. As more investors seek alternative assets that provide a tangible and emotionally fulfilling investment experience, racehorse breeding has emerged as a compelling choice. We are proudly the first company to offer Australian investors the opportunity to purchase fractional ownership shares in carefully selected Australian broodmares backed by blockchain.

BTX Breeding allows investors to purchase ownership rights into five broodmares that have been carefully selected by our team of expert Bloodstock analysts. Each broodmare is expected to produce two foals across the next two years. Your investment will include the same ownership in the foals as you have in the broodmare and financial returns will be generated via the sale of the foals at future auctions across Australia. As an investor, you will have the opportunity to take part in every part of the breeding process starting with broodmare ownership, to foaling, down to watching your horses being prepped for the sales, with the ultimate goal of being able to enjoy the potential success of their sale.

With over 42 years of experience, Blue Gum Farm is one of Australia’s leading breeding farms and BTX is proud to partner with Blue Gum Farm to offer our first breeding investment. The farm’s commitment to breeding excellence is evident in its graduates, who have achieved remarkable success on the racetrack. Further to this, Blue Gum Farm has an impressive track record as a leading vendor at the Melbourne Premier Yearling Sales, being named top vendor 4 out of the last 5 years. This brings investors on a unique journey with some of the best in the industry.

BTX Racing understands the immense possibilities within the world of alternative investments. By harnessing modern technologies and partnering with renowned industry experts like Blue Gum Farm, we aim to provide our investors with unparalleled opportunities in the realm of thoroughbred breeding. With BTX Breeding, you can diversify your investment portfolio, engage in the thrilling journey of breeding racehorses and potentially reap the rewards of a successful sale.

The BTX platform provides a user-friendly interface that is entirely regulatory compliant. Educational resources and a simplified investment process make it easy for individuals to explore and invest in alternative assets. Please take the time to explore the BTX website and mobile application where you will find available racing and breeding ownerships.

As the world of alternative investments continues to evolve, it is important for investors to stay informed, assess risks and seize the possibilities that align with their goals and aspirations. Each investor should read the relevant product disclosure documents on our website and assess their own risk appetite before making an investment.

Learn more from the Breeding page